Streamline and automate your lending by combining LoanStack’s modern loan origination capabilities, powerful underwriting tools and unique online customer experiences.

DIGITAL LOANS

The Next-Gen Platform

for Automated Digital Lending

Coming Soon!

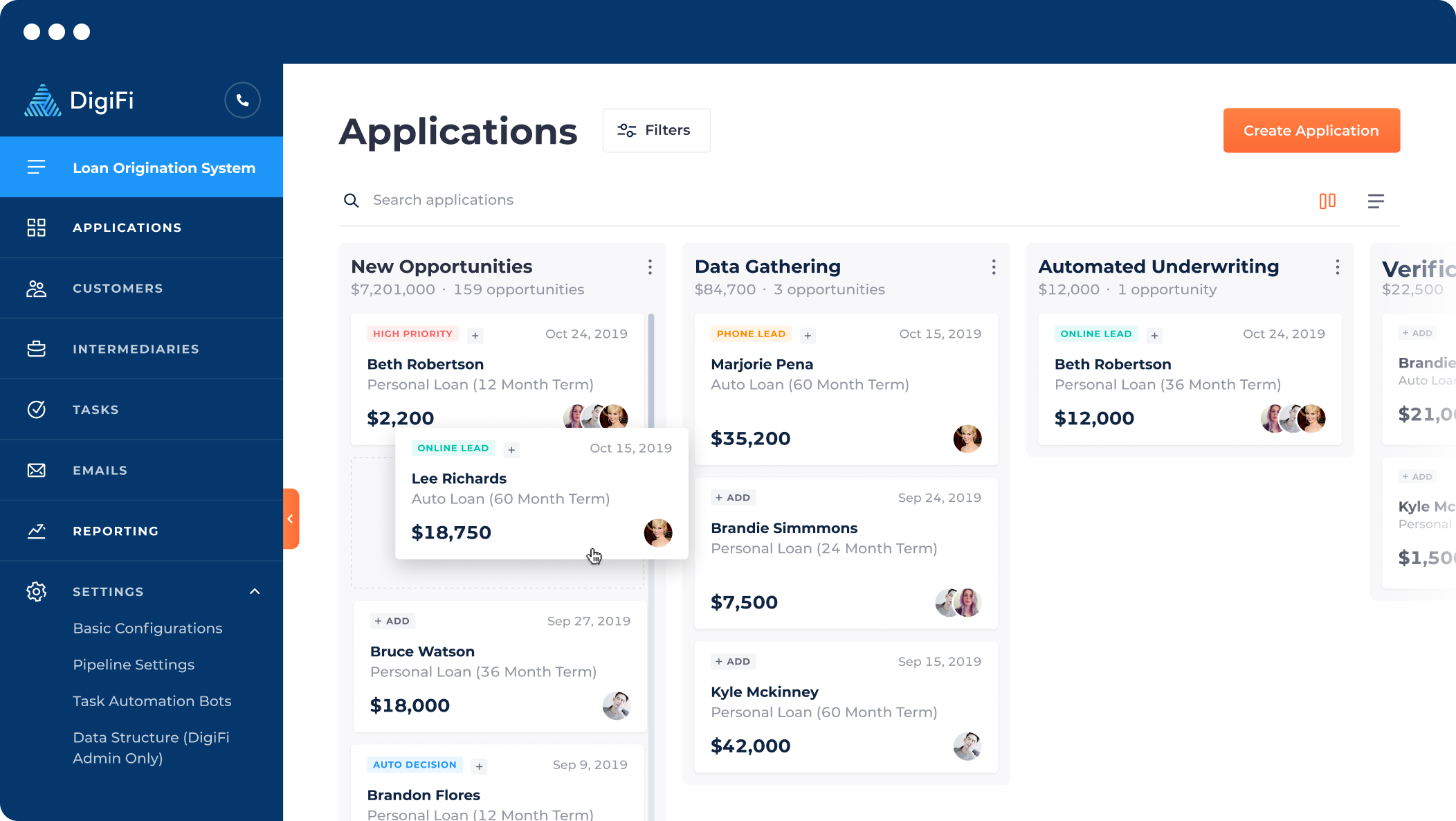

Loan Origination System

- Configurable Workflows

- Automated Decisioning

- Tasks & Activities

- Document Management

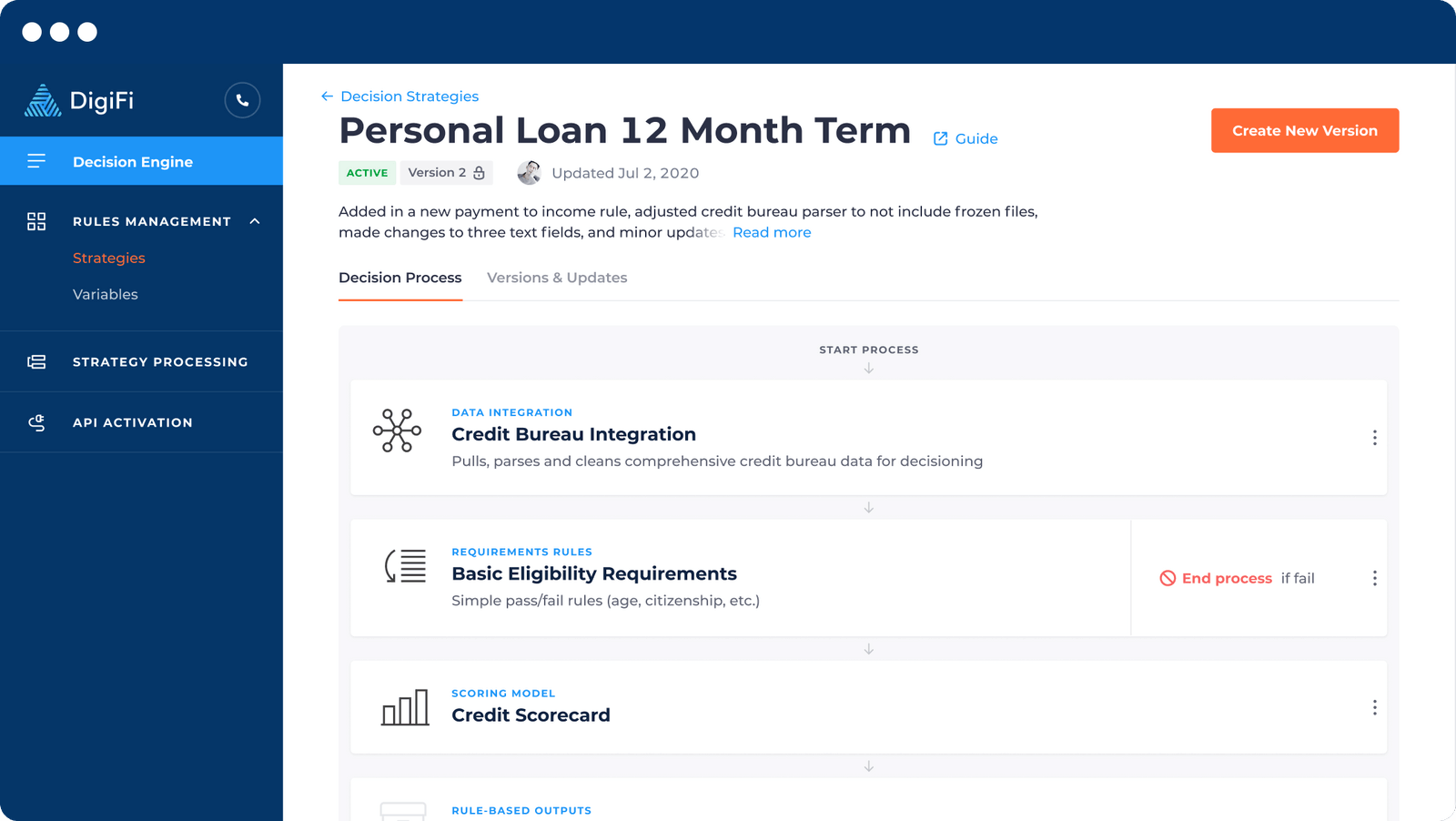

Automated Decision Engine

- Intuitive Decision Flows

- One-Click Deployment

- No-Code Rule Building

- Version & Change Controls

Loan Origination Software

Powerful Capabilities

Highly Configurable

Documents, reporting & email

Built-in reporting, document management, e-sign and emails eliminate work and ensure compliance

Easy application processing

Easily process applications and seamlessly manage customer and intermediary relationships over time

Tasks & activities

Manage workflows with ease by creating and assigning tasks and activities among team members and task bots

Extensible API

We make it easy to connect other systems and add digital lending tools that delight your customers

Automation & machine learning

LoanStack's LOS connects directly to our automated underwriting and machine learning capabilities

Bank-level security

LoanStack.io is SOC 2 compliant and our LOS includes security features such as 2-factor auth and data encryption

Automated Decision Engine

No-Code Lending

Automation

Transparent rules

Our decision engine provides visual, drag-and-drop workflows and built-in testing to eliminate black boxes

Instant processing

Decisions can be automatically generated in real-time or batch processes, with comprehensive audit trails

Data integrations

We make it easy to establish direct connections to third-party data sources, such as credit bureaus

API-based integration

Other systems can easily connect to underwriting workflows via automatically-generated API endpoints

Bank-level compliance

We’re SOC 2 compliant and our platform provides versions, change tracking and decision reasons

Predictive models

In addition to processing data and rules, our system can handle scorecards and complex coded models